OptimumBank Holdings (OPHC)·Q4 2025 Earnings Summary

OptimumBank Posts Record Quarter as Assets Cross $1 Billion

February 2, 2026 · by Fintool AI Agent

OptimumBank Holdings (OPHC) delivered its best quarter ever in Q4 2025, posting net income of $4.85 million ($0.42 basic EPS, $0.21 diluted EPS) while crossing the $1 billion asset threshold for the first time . The South Florida community bank's stock rose 2.5% to $4.83 on the news, reaching a fresh 52-week high.

Full year 2025 net income reached $16.64 million, up 27% from $13.12 million in 2024. Chairman Moishe Gubin called it "the best quarter and the best year we have ever had" .

Did OptimumBank Beat Earnings?

As a microcap community bank ($56M market cap), OptimumBank does not have sell-side analyst coverage, so there are no consensus estimates for comparison. However, the results demonstrate clear momentum:

Q4 2025 marked the fourth consecutive quarter of net income above $3.6 million, demonstrating consistent profitability .

How Did the Stock React?

OPHC shares rose 2.5% to $4.83 on the earnings release, touching a new 52-week high of $4.90 intraday. The stock has gained 37% from its 52-week low of $3.53.

What Drove the Record Quarter?

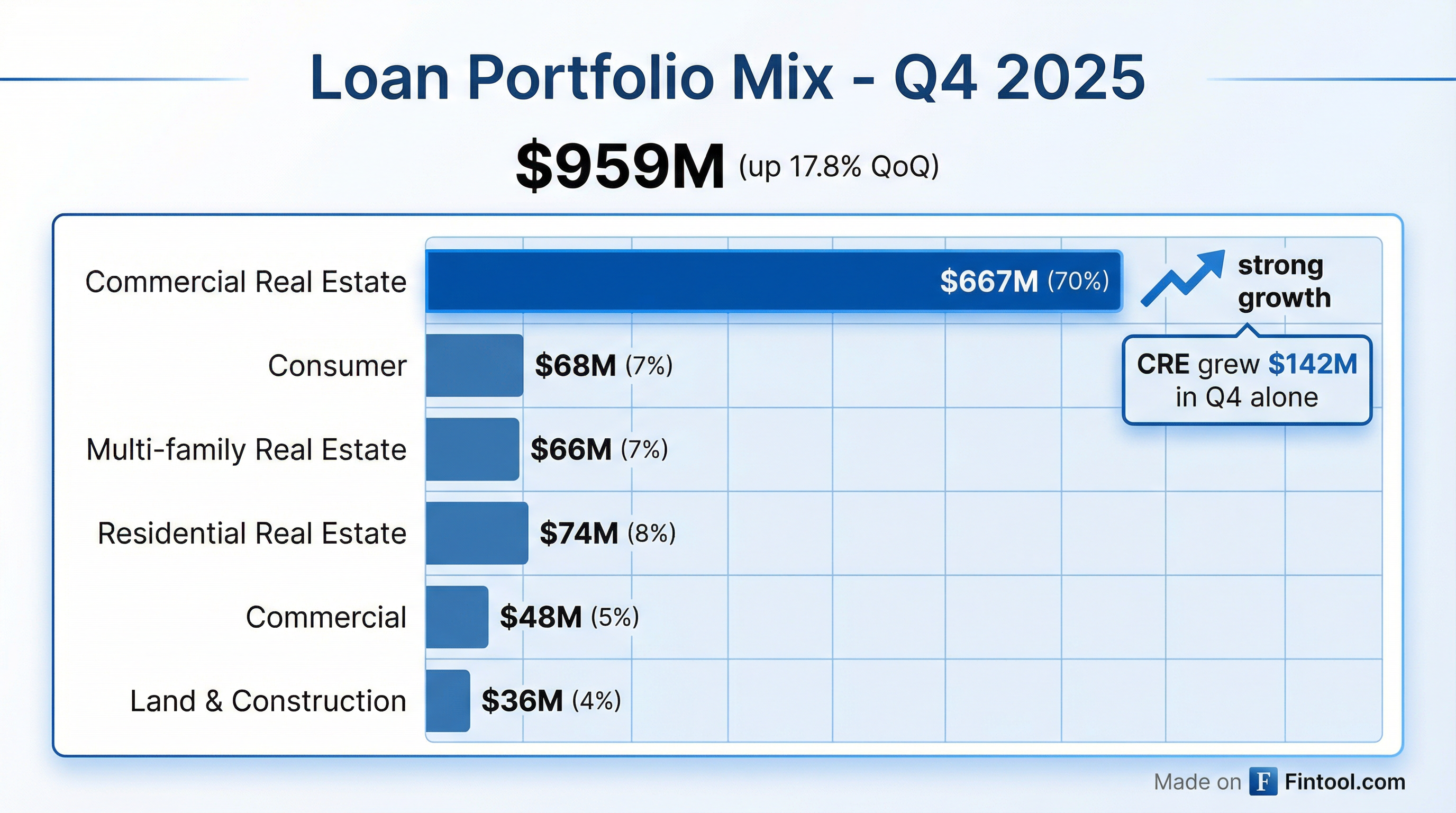

Explosive Loan Growth

The standout number was 17.8% quarterly loan growth — gross loans increased $145 million to $959 million in a single quarter . Commercial real estate drove the expansion, growing $142 million alone .

Management attributed the growth to their "relationship-based banking model" and lender success in winning new business .

Net Interest Margin Expansion

Net interest margin expanded to 4.39%, up 2 basis points from Q3 and up 20 basis points from Q4 2024 . The improvement came from two factors:

- Lower funding costs: Cost of interest-bearing liabilities fell to 3.34%, down 14 bps QoQ and 68 bps YoY

- Loan growth: Average loan balances increased $76 million from Q3

Profitability Metrics

The 16.23% ROAE is well above the community bank average of ~10-12%, reflecting efficient capital utilization.

Balance Sheet Highlights

Total assets crossed $1.11 billion, up $179 million (19%) from year-end 2024 . Key balance sheet movements:

Deposits declined 2.9% QoQ, primarily due to a $47 million decrease in noninterest-bearing demand deposits related to "year-end business account seasonality" . The bank tapped $50 million in FHLB advances to fund loan growth .

Credit Quality

Asset quality remained strong with minimal credit losses:

- Nonaccrual loans: $2.90M (0.30% of loans), down from $7.58M a year ago

- Credit loss expense: $0.40M, down from $0.76M in Q3

- Net charge-offs: $134K (0.01% of loans)

- ACL/Loans: 1.07%, down from 1.23% in Q3

The allowance coverage ratio declined due to the rapid loan growth, but management noted "improvements in the credit quality of the loan portfolio" .

What Did Management Say?

Chairman Moishe Gubin was bullish on the outlook:

"We ended 2025 with the best quarter and the best year we have ever had. Our focus remains simple and effective. We are now on the cusp of fully realizing our strategic plan, which includes expanding into new, financially related verticals that complement our banking operations. We've built the foundation, and we are excited to unveil the next phase of this journey in the near future."

What's the 2026 Outlook?

Management announced a new subsidiary focused on HUD/FHA insured loan origination for multifamily and healthcare properties, expected to launch in 2026 . The platform will offer:

- Bridge-to-HUD financing

- FHA and HUD insured loan origination

- Focus on skilled nursing, senior housing, and multifamily sectors

The company also noted continued investment in "technology, talent, and targeted growth strategies" to maintain momentum as "one of the most dynamic and rapidly growing community banks in South Florida" .

Capital Position

Capital ratios remain strong:

Tangible book value per share increased 7.4% QoQ and 19.2% YoY, reflecting strong earnings retention.

Full Year 2025 Summary

Key Takeaways

- Record performance: Best quarter and best year in company history

- Growth engine firing: 17.8% loan growth in a single quarter, crossing $1B in assets

- Margin expansion: NIM at 4.39% with funding costs declining

- Clean credit: Nonaccruals down 62% YoY, minimal charge-offs

- Capital deployment: New HUD/FHA subsidiary launching in 2026

- Valuation: Stock at 0.46x TBV (using non-diluted) or 0.93x diluted TBV

OptimumBank Holdings, Inc. (NYSE American: OPHC) is a bank holding company headquartered in Fort Lauderdale, Florida. OptimumBank is a Florida-chartered commercial bank wholly owned by the company.

Related Links: